uBind is proud to be the technology provider behind the newly launched Zest Insurance, a cutting-edge digital insurance platform designed specifically for Australian SMEs, brought to market by Willis, a WTW (Willis Towers Watson) business.

This transformative platform delivers a frictionless customer journey, from quote to purchase and beyond – setting a new standard for digital insurance experiences in the Australian market.

A seamless experience from start to finish

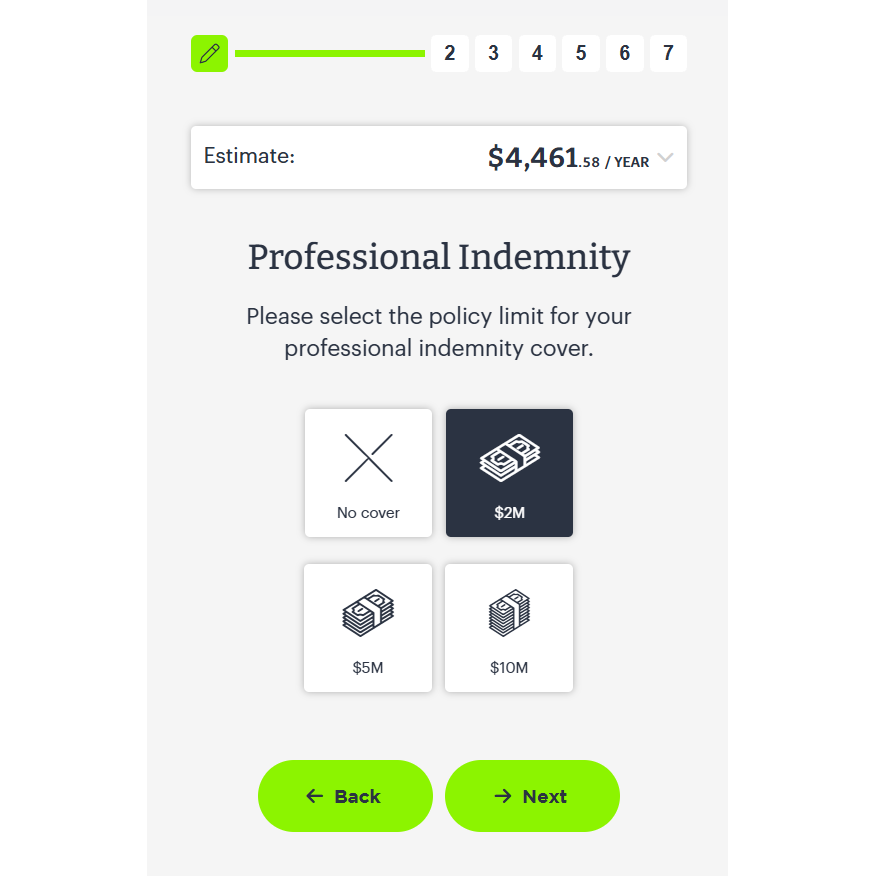

At the core of the Zest Insurance platform is a customer-first philosophy, drawing on decades of UX design experience in the insurance sector. The team at uBind worked closely with Willis to shape an intuitive, guided journey from the moment a customer enters the website through to fully binding a policy. Every interaction was deliberately crafted to feel modern, and effortless, and snappy. uBind’s optimised ratings engine delivers pricing in as little as 300 milliseconds.

Full self-service and fully embedded

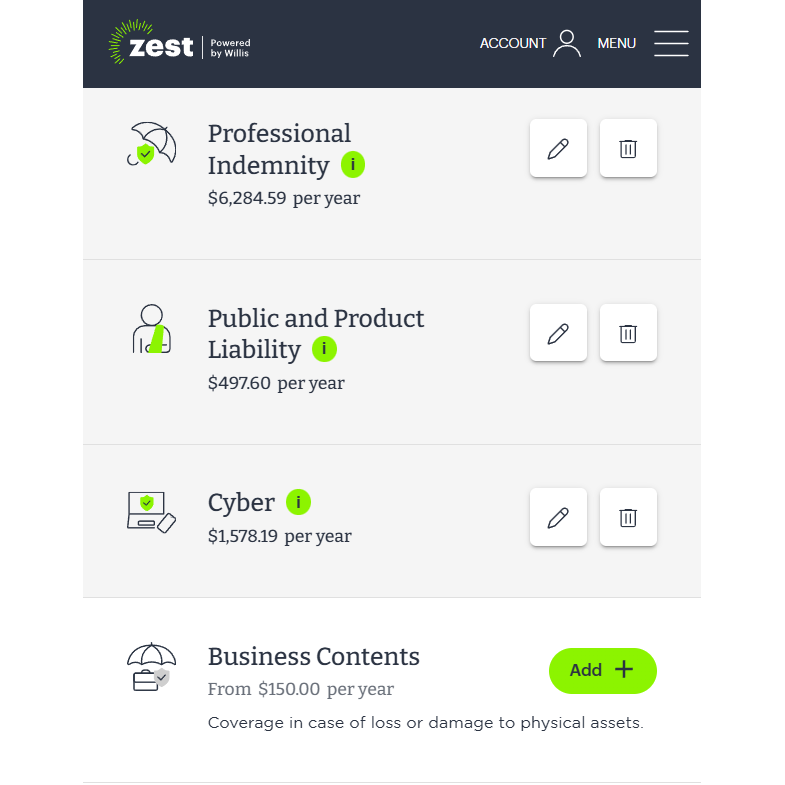

One of the hallmarks of the new Zest Insurance experience is a fully integrated customer portal, embedded directly into the public website. This gives customers the ability to

self-manage their insurance at any time, including the ability to add or remove covers, update policy details, or download documents, all without needing to speak to an agent.

Built for autonomy, not just automation

The platform enables complete self-service while still supporting complex underwriting logic behind the scenes. Whether it’s a new customer onboarding or a mid-term adjustment, the system is designed to put control in the hands of the customer, without sacrificing compliance or business rules.

“SMEs are the backbone of the Australian economy, yet many still face outdated, complex processes when it comes to insurance. They increasingly demand convenience, speed and tailored insurance solutions. Zest Insurance is our answer to that challenge.”

Brent Lehmann, Head of Commercial & Affinity, Pacific at Willis

A model of collaboration

The success of the Zest Insurance launch is also a testament to how well teams can work together when united by a shared vision.

“This was not just a technology build. It was a true collaboration between Willis and uBind to shape the next evolution of customer experience in purchasing and managing insurance digitally.”

John Gamble, CEO of uBind

From initial scoping through to launch, both teams engaged in an agile, transparent working model that accelerated decision-making and fostered innovation.

The future of SME insurance, delivered today

Zest Insurance sets a new bar for what digital insurance platforms can achieve when product vision, technical execution, and user-centric design are perfectly aligned. uBind is proud to be the engine behind this leap forward and is excited to continue supporting Willlis as they expand Zest’s reach across Australia.

About uBind

uBind is a leading insurtech company powering scalable, digital-first insurance solutions. With a proven track record of delivering modern customer experiences and deep integrations, uBind helps insurers and brokers launch faster, operate smarter, and grow sustainably.